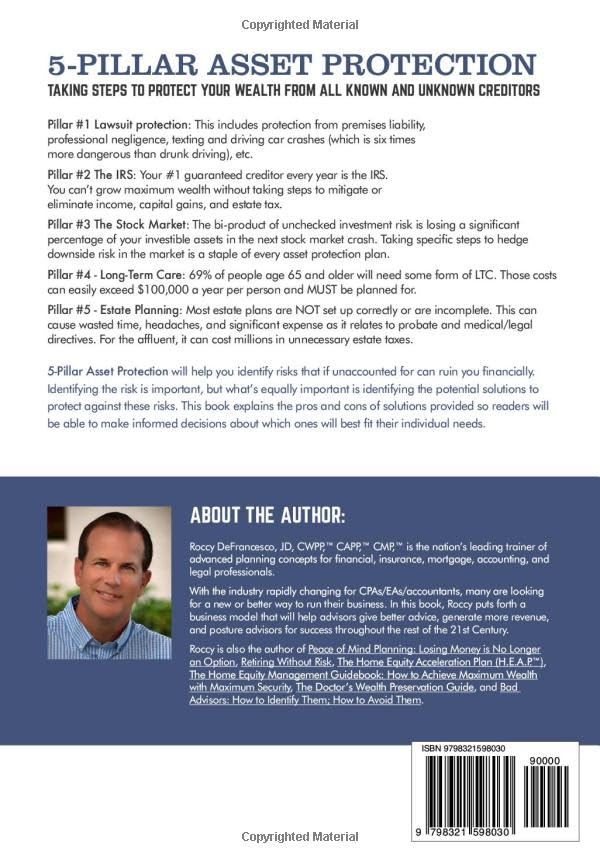

5-Pillar Asset Protection

$24.95

Pillar #1 Lawsuit protection: This includes protection from premises liability,

professional negligence, texting and driving car crashes (which is six times

more dangerous than drunk driving), etc.

Pillar #2 The IRS: Your #1 guaranteed creditor every year is the IRS.

You can’t grow maximum wealth without taking steps to mitigate or

eliminate income, capital gains, and estate tax.

Pillar #3 The Stock Market: The bi-product of unchecked investment risk is losing a significant percentage of your investible assets in the next stock market crash. Taking specific steps to hedge downside risk in the market is a staple of every asset protection plan.

Pillar #4 • Long-Term Care: 69% of people age 65 and older will need some form of LTC. Those costs can easily exceed SI 00,000 a year per person and MUST be planned for.

Pillar #5 • Estate Planning: Most estate plans are NOT set up correctly or are incomplete. This can cause wasted time, headaches, and significant expense as it relates to probate and medical/legal directives. For the affluent, it co cost millions in unnecessary estate taxes.

5-Pillar Asset Protection will help you identify risks that if unaccounted for can ruin you financially. Identifying the risk is important, but what’s equally important is identifying the potential solutions to protect against these risks. This book explains the pros and cons of solutions provided so readers will be able to make informed decisions about which ones will best fit their individual needs.

$24.95

$49.95

Related products

Student Loan Eliminator

Student Loan Eliminator Software

Medicaid Planning Guidebook

Bad Advisors Paperback

Asset Protection Products

Site by: Innova Cloud Hosting